MT4 after twenty years: an honest take on the platform

MT4 in 2026: why it refuses to die

MetaQuotes stopped issuing new MT4 licences a while back, pushing brokers toward MT5. But most retail forex traders kept using MT4. The reason is not complicated: MT4 works, and people trust what works. Thousands of custom indicators, Expert Advisors, and community scripts only work with MT4. Migrating to MT5 means porting that entire library, and few people can't justify the effort.

After testing MT4 and MT5 side by side, and the gap is smaller than you'd expect. MT5 adds a few extras such as more timeframes and a built-in economic calendar, but chart functionality is about the same. If you're weighing up the two, MT4 still holds its own.

Getting MT4 configured properly the first time

Downloading and installing MT4 is the easy part. Where people waste time is configuration. By default, MT4 shows four charts squeezed onto a single workspace. Close all of them and start fresh with the instruments you follow.

Templates are worth setting up early. Configure your go-to indicators on one chart, then right-click and save as template. Then visit this site you can apply it to any new chart without redoing the work. Sounds trivial, but over months it adds up.

A quick tweak that helps: go to Tools > Options > Charts and tick "Show ask line." By default MT4 displays the bid price by default, which makes your entries look off by the spread amount.

How reliable is MT4 backtesting?

MT4 comes with a backtester that gives you the ability to run Expert Advisors against historical data. Worth noting though: the quality of those results hinges on your tick data. Built-in history data from MetaQuotes is not real tick data, meaning the tester fills gaps using algorithms. For anything more precise than a quick look, download real tick data from a provider like Dukascopy.

Modelling quality matters more than the bottom-line PnL. Below 90% means the results aren't trustworthy. I've seen people show off backtests with 25% modelling quality and ask why live trading looks different.

The strategy tester is one of MT4's stronger features, but the output is only useful with quality tick data.

Building your own MT4 indicators

MT4 ships with 30 standard technical indicators. Most traders never touch them all. That said, the real depth is in custom indicators coded in MQL4. You can find thousands available, spanning simple moving average variations to elaborate signal panels.

Adding a custom indicator is simple: copy the .ex4 or .mq4 file into the MQL4/Indicators folder, reboot MT4, and it appears in the Navigator panel. The risk is reliability. Free indicators vary wildly. Some are well coded and maintained. Many are abandoned projects and will crash your terminal.

Before installing anything, check when it was last updated and if other traders mention bugs. A broken indicator won't just give wrong signals — it can lag the whole terminal.

The MT4 risk controls you're probably not using

You'll find a few native risk management options that a lot of people never configure. First worth mentioning is the maximum deviation setting in the order window. This controls the amount of slippage you'll accept on market orders. Leave it at zero and you'll get whatever price the broker gives you.

Stop losses are obvious, but the trailing stop function is worth exploring. Click on an open trade, select Trailing Stop, and set your preferred distance. Your stop loss follows automatically as price moves in your favour. It won't suit every approach, but for trend-following it removes the temptation to stare at the screen.

These settings take a minute to configure and the difference in discipline is noticeable over time.

Expert Advisors — before you trust a robot with your money

Automated trading through Expert Advisors sounds appealing: program your strategy and stop staring at charts. In practice, most EAs fail to deliver over any meaningful time period. EAs marketed using flawless equity curves are usually over-optimised — they worked on the specific data they were tested on and stop working once market conditions change.

This isn't to say all EAs are useless. A few people code personal EAs to handle well-defined entry rules: opening trades at session opens, automating position size calculations, or taking profit at predetermined levels. These smaller, focused scripts tend to work because they handle repetitive actions without needing interpretation.

Before running any EA with real money, use a demo account for no less than several weeks in different conditions. Live demo testing tells you more than backtesting alone.

Using MT4 outside Windows

MT4 was built for Windows. If you're on macOS deal with a workaround. Previously was Wine or PlayOnMac, which did the job but introduced display glitches and stability problems. Certain brokers now offer Mac-specific builds wrapped around Crossover or similar wrappers, which are better but still aren't true native apps.

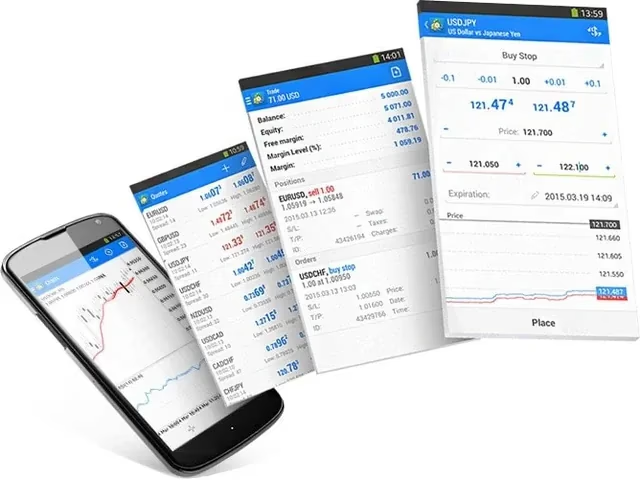

MT4 mobile, available for both Apple and Android devices, work well for watching your account and tweaking stops. Doing proper analysis on a mobile device is pushing it, but closing a trade from your phone is worth having.

Check whether your broker offers a proper macOS version or just Wine under the hood — the experience varies a lot between the two.